47+ one extra payment a year on a 30 year mortgage

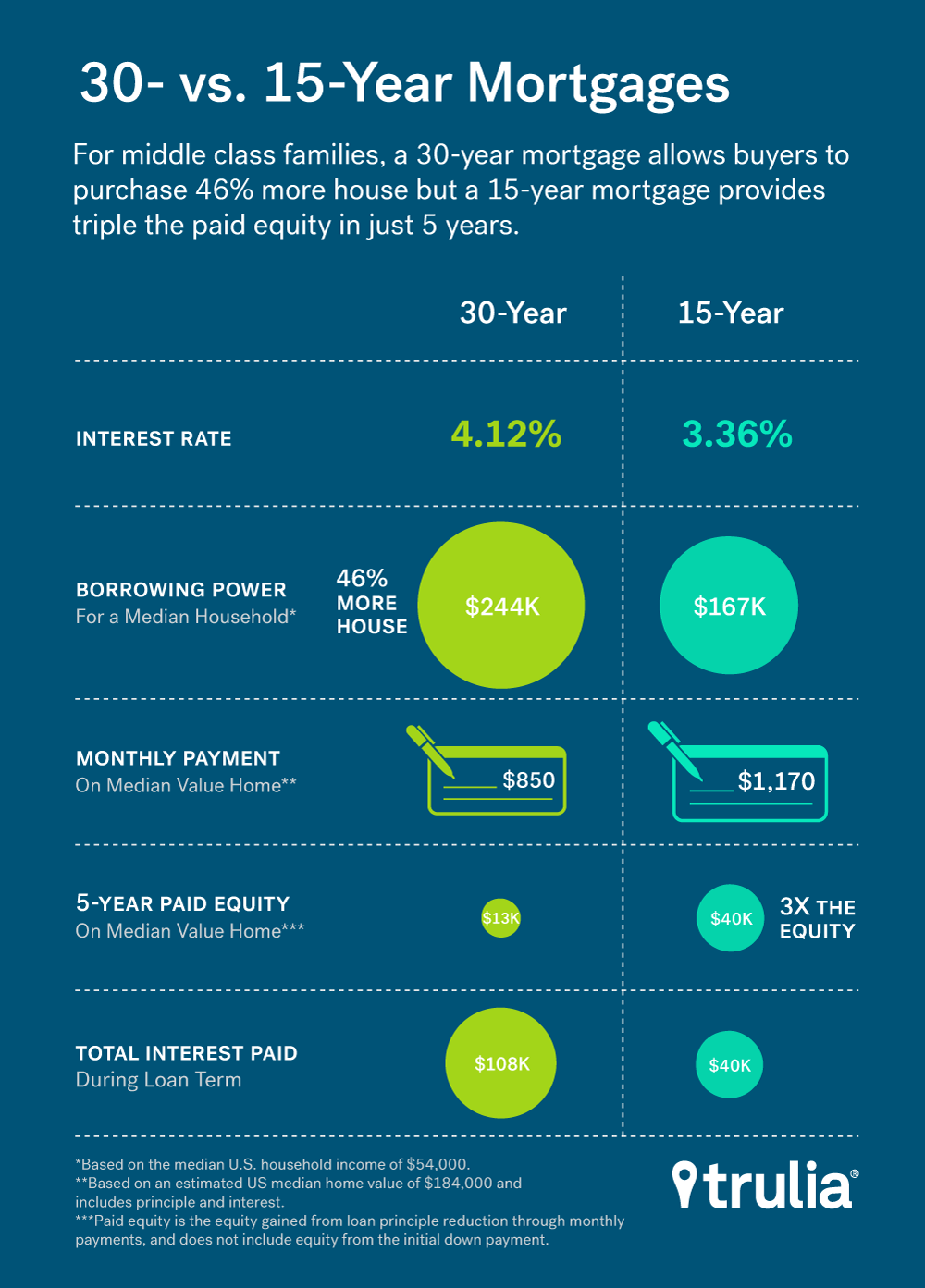

Web The 15-year mortgage tends to have a lower interest rate though mortgage rates overall have been low for some time. A Rating With Better Business Bureau.

Jonathan Ritter Sur Linkedin Costofrent Rentincrease Tiredofrenting Renttrap Landlord Mortgage

Over 15 Million Customers Since 2005.

. Web If you make an extra monthly payment of 2098 each December youll pay off your 30-year mortgage five years ahead of schedule and net about 82730 in. Estimate Your Monthly Payment Today. Web Mortgage lenders dont add borrowers 13th payment until the year is complete resulting in less interest accrual and reducing the amount applied to your loans principal.

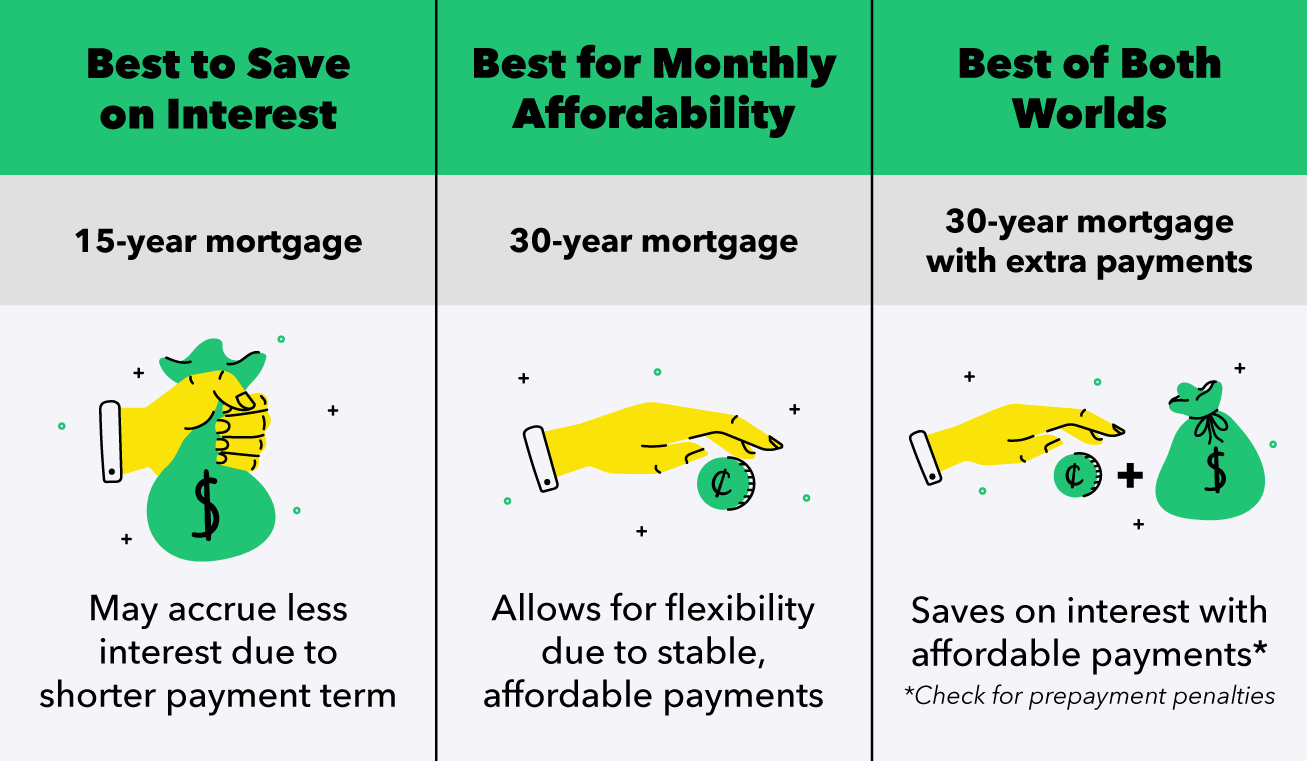

Web And that means if you add just one extra payment per year youll knock years off the term of your mortgageplus save thousands of dollars in interest. Web For interest rates as of June 2022 a 30-year fixed-rate mortgage sits at 618 a 315 rise from the previous year. But imagine you make an extra 100 payment each month toward your principal.

This is a savings of. In this scenario you would then increase the amount you. Coast Guard wants 16.

Web Thats the extra money you would add to each monthly payment to chip away at your mortgage balance. A 15-year fixed mortgage sits at 538 a. A 15-year mortgage gives you 15 years to pay.

Web An extra mortgage payment calculator can help you visualize how making extra payments may reduce the amount of interest paid over the lifetime of the loan. More Veterans Than Ever are Buying with 0 Down. Paying extra on your mortgage means that you make additional payments to your principal loan balance beyond your regular.

Web Paying extra on your mortgage. However the monthly payments are higher. If you put a 5 down payment on a 275000 30.

Web There arent a uniform number of days in each month and so by making biweekly mortgage payments youll make 26 half-payments or 13 full payments. Web If you make the initial extra payment amount you entered and pay just 5000 more each month you will pay only 38027766 toward your home. A word of caution.

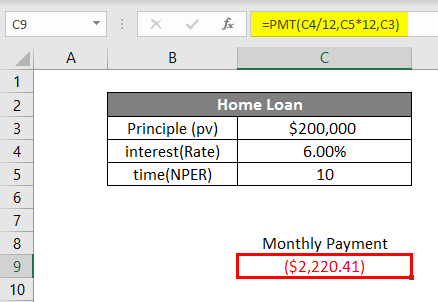

Web The 30-year fixed-rate mortgage calculator estimates your monthly payment as well as the loans total cost over the term. Web Adding an Extra Mortgage Payment of 10 Per Month. Web The cost of PMI for a conventional home loan averages 058 to 186 of the original loan amount per year.

Web 52 minutes agoNorth Dakota to exempt military pay from income taxes. Ad Our Technology Will Match You With The Best Lenders At Super Low Rates. Web The primary difference between a 15-year mortgage and a 30-year mortgage is how long each one lasts.

Trusted VA Home Loan Lender of 300000 Military Homebuyers. Difference between a 15 and a 30 year mortgage Money Minute. Web The total interest paid over 30 years would be 104300.

With a home price of 400000 an 80000 down. Web Use this amortization calculator to help you determine how many months it could take to pay off your loan with or without making extra payments. Lets start with a simple scenario where you add just 10 a month in extra payment to principal.

Mortgage Comparison 30 Year At 4 75 Vs 15 Year At 3 75 My Money Blog

Up North Home Showcase June 2019 By 5 Star Marketing Distribution Issuu

Should You Make An Extra Mortgage Payment Firstbank Mortgage

Two Extra Mortgage Payments A Year Can Save You 64 000

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

How Much Money Will I Save By Making An Extra Mortgage Payment A Year On A 30 Year Loan

No Savings Living Paycheck To Paycheck Importance Of An Emergency Fund

Extra Payment Mortgage Calculator Making Additional Home Loan Payments

Mortgage With Extra Payments Calculator

How 1 Extra Mortgage Payment A Year Helps Pay Off Your Home Faster

15 Year Vs 30 Year Mortgages Which Is Better Midsouth Community Federal Credit Union

Home Loan Emi Calculator Calculate Housing Loan Emi Online Axis Bank

Pw C Sept21 By Display Pennywise Issuu

Where 15 Can Beat 30 Trulia Research

Early Mortgage Payoff Calculator

How To Pay Off Your 30 Year Mortgage In 15 Years Moneytips

Extra Payment Mortgage Calculator Making Additional Home Loan Payments